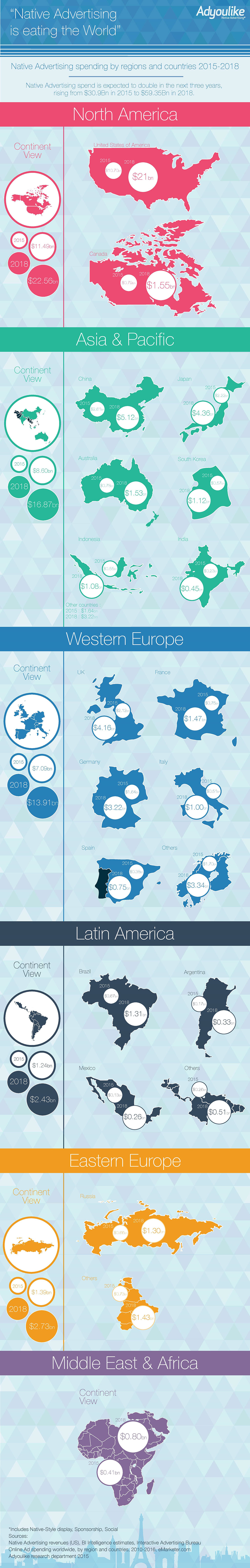

Data released by Adyoulike, Europe’s largest native advertising network, shows how the value of native advertising worldwide is expected to almost double over the next three years, rising from $30.9bn in 2015 to $59.35bn in 2018.

Data released by Adyoulike, Europe’s largest native advertising network, shows how the value of native advertising worldwide is expected to almost double over the next three years, rising from $30.9bn in 2015 to $59.35bn in 2018.

The data is the first time that native advertising growth has been charted globally. In North America, the native advertising market is expected to soar from $11.49bn in 2015 to $22.56bn in 2018, while Western Europe is expected to see growth over the same period from $7.09bn to $13.91bn. Other markets like Asia-Pacific and Latin America are set to see equally impressive expansion.

Commenting on the figures, Julien Verdier, CEO at Adyoulike, said: “The industry has previously been largely working from old and out-of-date numbers, but now the true picture of how native advertising is ‘eating the world’ is coming into view.

“In particular, 2015 was a big year for native as it truly became part of the digital mainstream: spend is now tracked by PwC, it often has separate budgets with money moving into native from display, and the arrival of the OpenRTB 2.3 standard has allowed advertisers to distribute genuinely creative native content programmatically for the first time.

“Native is succeeding because it answers a lot of the issues with display ads: creative, high-quality content is delivered in-feed in a way that works perfectly on mobiles and smaller screens.

“And it’s going to keep growing massively over the next few years as brands and publishers understand what native can offer – and how it provides the creative shot in the arm that digital advertising sorely needs. More people are also using native programmatically and that means we’ll see even more scale and more trading across national and regional borders.”

The figures have been pooled together by Adyoulike’s research department and uses sources including: native advertising revenues (US), BI Intelligence estimates, IAB Online Ad spending worldwide figures by region and countries (2010-2016) and data from eMarketer.com.

You must be logged in to post a comment Login