New research has shown a significant increase in M&A deal activity involving content production companies, more than doubling from 35 acquisitions globally in 2018 to 82 in 2019.

In the last weeks of 2019 alone, Blackstone invested £100m for a minority stake in content development house HH Global and Tech Mahindra acquired retail content production agency BORN Group for $95m.

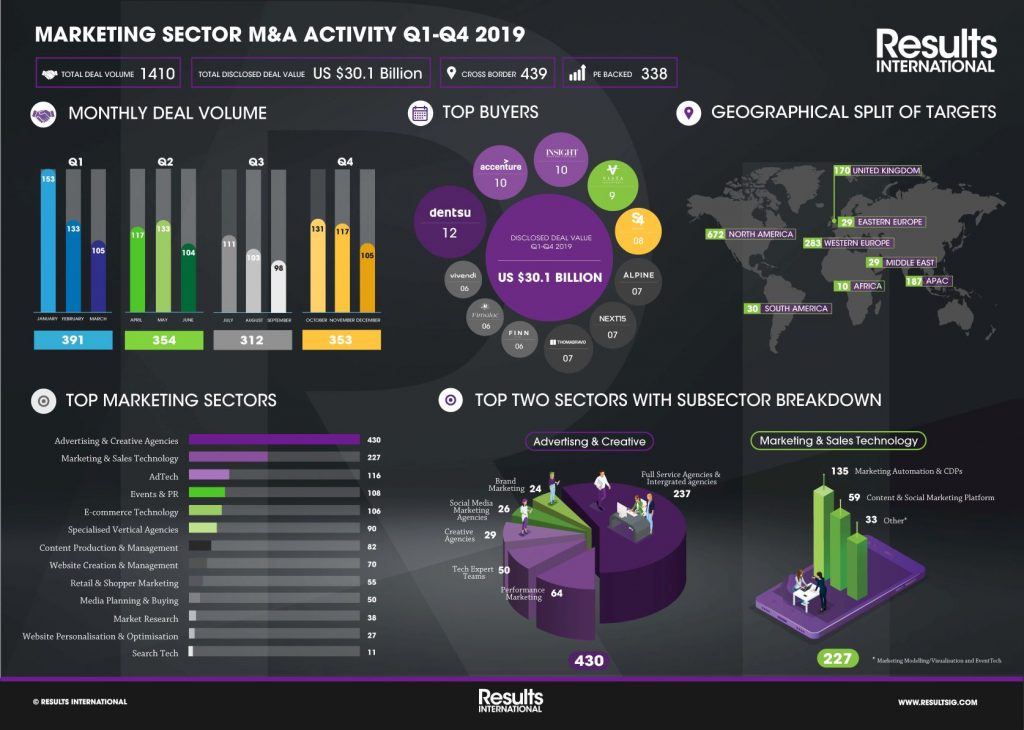

The analysis was carried out by Results International, leading global M&A and fundraising advisors to the marketing, technology and healthcare sectors. It found that there were 1,410 marketing sector deals in total in 2019, a 9% increase from the previous year, of which 557 were in martech*/adtech. In fact, last year saw the number of martech/adtech deals jump by 37% compared to 2018.

Overall, the most active sector within marketing services in 2019 was advertising & creative agencies with 430 deals. Within advertising & creative, full-service agencies was the number one subsector, highlighting the continuing trend of brands seeking full-funnel transformation.

The second most active sector for the year was marketing & sales technology with 227 deals, with marketing automation & CDPs the most active subsector at 135 deals.

Julie Langley, partner at Results International, comments: “Identity resolution was a major area of focus in 2019, which led to an increased focus on CDPs and other companies that have the ability to unify disparate data sources to create a single customer view. This led to increased M&A and investments in the space, conducted by both financial and strategic buyers alike.”

“The growing interest in content companies matches the blisteringly fast growth in formats, devices and communications needs seen by brands worldwide in recent years. Advertisers need to think big but hit small on an always-on basis. Companies that have the ability to produce a wide range of personalised content at scale on multiple devices, and in different markets are highly sought after.”

The research also found that private equity continues to invest in the marketing industry. Remaining consistent with 2018’s private equity acquisitions pace, 2019 accounted for roughly a quarter (24%) of total deals 338 deals, jumping by almost 94% from 2017.

60% of the private equity deals in volume last year were within marketing services. Performance marketing firms have been particularly attractive. A number of UK independent firms received investments from PE as a result: Brainlabs received a minority investment from Livingbridge in March; Jellyfish and Croud received investment from French diversified private investment arm Fimalac and LDC respectively in November. It’s also worth noting the investment in established creative and design shop Jones Knowles Ritchie from PE firm Growth Capital Partners in July. Larger firms are also investing in the space as shown by the December’s acquisition of Dutch mid-market marketing group DEPT by Carlyle.

Julie Langley continues: “2019 has been very active for private equity acquiring UK marketing services assets, particularly performance marketing companies traditionally providers of ROI. As far as technology is concerned, while PE investors are primarily attracted to martech due to its SaaS revenue model and high gross margins, as seen by Vista Equity’s nine acquisition in the space last year, they have traditionally been more cautious when it comes to investing in adtech. This is due to a larger mix of transaction-based revenue models, less direct relationship with brands, increased privacy compliance issues and the dominance of the triopoly (Google, Facebook and Amazon).

“However, this has not impeded private equity firms from making investments in sought-after and differentiated adtech assets. For example, Blackstone’s $750m acquisition of Vungle in July and Providence’s $222m majority investment in Finnish social media firm Smartly.io in December.”

The analysis also showed that the traditional holdcos reduced their deal activity to focus on internal restructuring and acquiring tech-enablers rather than technologies themselves. Only Dentsu made the top buyers list with 12 acquisitions in 2019 – far from the 34 deals it made in 2018. Of the eleven most active buyers last year, five were private equity.

However, 2019 also saw some intriguing new buyers: household-name brands looking to take back control of their data to personalise customer experience further. McDonald’s acquired Apprente and Dynamic Yield, Nike acquired Celect, a leading retail predictive analytics company, while Walmart bought Polymorph, Aspectiva and assets of Triad Retail Media. In addition, Paypal made its largest deal to date, acquiring Honey for $4bn, further expanding its presence in customer journey optimisation.

While Northern America remained the most active target region in 2019 with 672 deals, the region which saw the most growth last year was the Middle East with a 123% increase, albeit from a modest starting point of 13 deals in 2018. Of the 29 deals in that region last year, 27 were Israeli businesses. Most were in the martech/adtech sector, such as Qlik Technologies, a Thoma Bravo portfolio company, acquiring Israeli-listed CDP Attunity for $560m in February.

LATAM also saw an increase in activity in 2019. Of the 30 South American companies acquired last year, 21 were based in Brazil and two-thirds of those were in the martech/adtech space. For example, S4 Capital’s MightyHive acquired the Brazilian programmatic advertising firm Progmedia Consultoria in April, S4 are continuing to expand their presence in LATAM in 2020, having acquired Mexican digital marketing agency Circus Marketing.

Julie Langley concludes: “Marketing services continue to be of real interest to buyers, particularly companies that offer full transformation, that are able to execute faster, and that focus on ROI. Technology continues to see an increase in deal activity as well, albeit in some cases coming from consolidation among historic assets. Companies taking advantage of the current trends, such as personalisation; measurement/analytics; and the growth in demand for quality content (video content in particular), remain well placed to attract investment.

“Beyond specific sectors, what we’re likely to see more of in 2020 is investors wanting results. The sector’s patience for companies unable to demonstrate profitability is wearing thin.”

Source: Results International

You must be logged in to post a comment Login