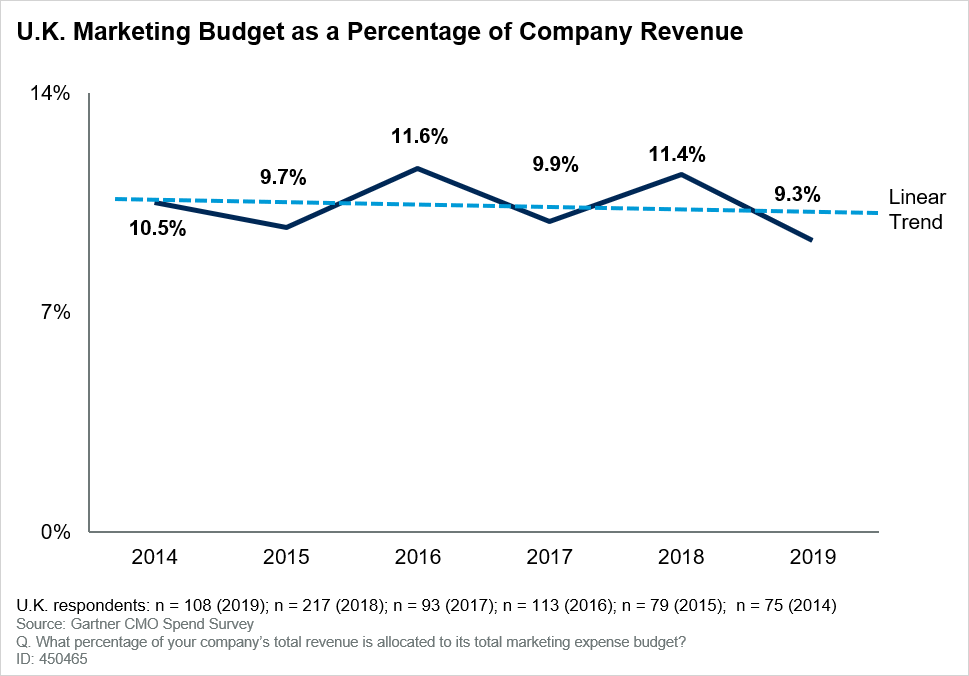

Marketing budgets in the U.K. have shifted downwards, dropping from 11.4% of overall company revenue in 2018 to 9.3% in 2019, according to a survey of chief marketing officers (CMOs) by Gartner, Inc. Findings fromGartner’s CMO Spend Survey 2019-2020 report reveal a drop of more than two percentage points year over year, placing U.K. marketing budget allocations significantly behind peers in the United States.

“U.K. marketing budgets have seen a significant amount of variance over recent years,” said Ewan McIntyre, vice president analyst in Gartner’s Marketing practice. “At their peak in 2016, budgets sat at 11.6% of company revenue. However, 2019 sees budgets fall to a lower level than at any point over the previous five years.”

“It would be easy to blame the sharp budgetary decline on the Brexit uncertainty reigning supreme. However, looking at the movement of U.K. marketing budgets over the last few years, it appears that U.K. budgets are much more volatile than those of their peers in North America. Nonetheless, U.K. CMOs remain positive about the economic and political situation, and its potential to disrupt business.”

The CMO Spend Survey 2019-2020, conducted with more than 430 marketing executives in the United States, Canada, France, Germany and the U.K., tracks the critical areas marketers are investing in from people, programs and technologies. The report looks at how much companies spend on marketing, how those budgets are built, how they will change in 2020 and why. Key findings from the CMO Spend Survey 2019-2020 in the U.K. include:

Digital Ad Spend Is Down, But Search Ad Budgets Are Up

U.K. CMOs are cooling off when it comes to digital ads, reducing investment from 11.8% of the marketing budget in 2018 to 8.0% in 2019. However, this excludes investments in search advertising, a channel that saw growth in the U.K. year over year, from 5.1% of the total budget in 2018 to 6.3% in 2019.

“Despite the decrease in investment, confidence in digital ads continues to grow,” said Mr. McIntyre. “In 2018, 68% of U.K. CMOs reported that they planned to increase digital advertising spend in 2019. Forward to this year, and this figure has jumped to 81%. However, care must be taken, as intent to grow investment is not always matched with budgetary commitment.”

Martech Spend Falls by Almost Six Percent

Technology budgets took a hit in 2019, falling from 31.7% of overall marketing expense budgets in 2018 to 25.8% in 2019. However, 71% of U.K. CMOs expect marketing technology (martech) budgets to increase in 2020 with almost a quarter (24%) anticipating the increase to be significant.

“This confidence is rooted in the fact that U.K. CMOs still see marketing technology as a vehicle for driving differentiation and competitiveness,” said Mr. McIntyre. “However, investment in technology doesn’t always deliver desired results.”

Gartner’s Marketing Technology Survey found that, overall, marketing leaders in the U.K. and North America report using only 58% of their martech stack’s full capabilities, stating that their martech was ineffective. “Marketers’ affinity for martech will likely be challenged in the future, unless they can prove that sizable investments are delivering transformative capabilities and experiences, and, most importantly, producing bottom-line value to the organisation,” added Mr. McIntyre.

Additional insights on U.K.-based CMOs’ spend are available to Gartner for Marketers clients in the report “2019-2020 CMO Spend Survey: U.K. CMOs’ Budgets Fall by Two Percentage Points, but They Face the Future With Confidence.”

Source: Gartner

You must be logged in to post a comment Login