ECI Media Management has today released its latest Media Inflation Report Update, which provides updated forecasts for media inflation in 2022. The report indicates that overall media inflation in the UK will be at 4.3% in 2022, down slightly from predictions of 4.4% earlier in the year.

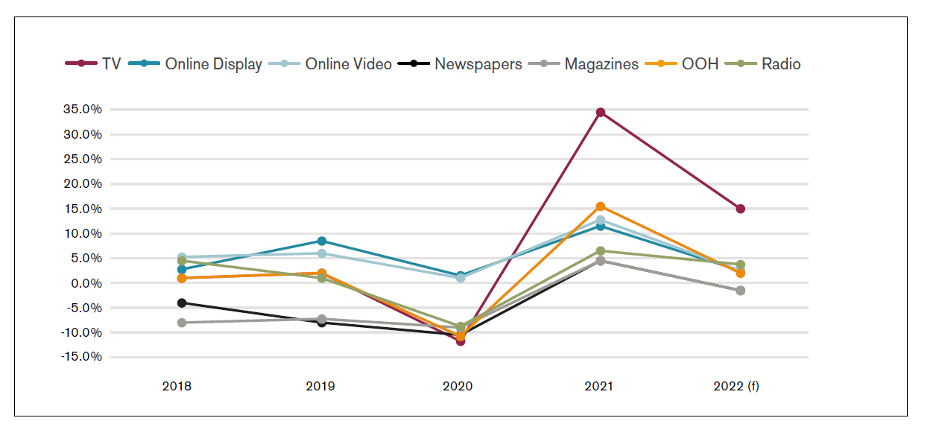

This small drop is driven largely by Online; inflation for Online Display and Online Video are both at 2.4% now, versus 3.8% and 4.9% respectively in Q1. Meanwhile, TV inflation is in fact forecast to be higher at 15% versus Q1 forecasts of 7.2%. Out of Home inflation is now expected to be 1.9% versus the 1.5% forecast in Q1, and Print will fall further into deflation, predicted to be -1.5% now versus the -0.5% forecast in the first quarter.

5-year trend, 2018-2022, UK

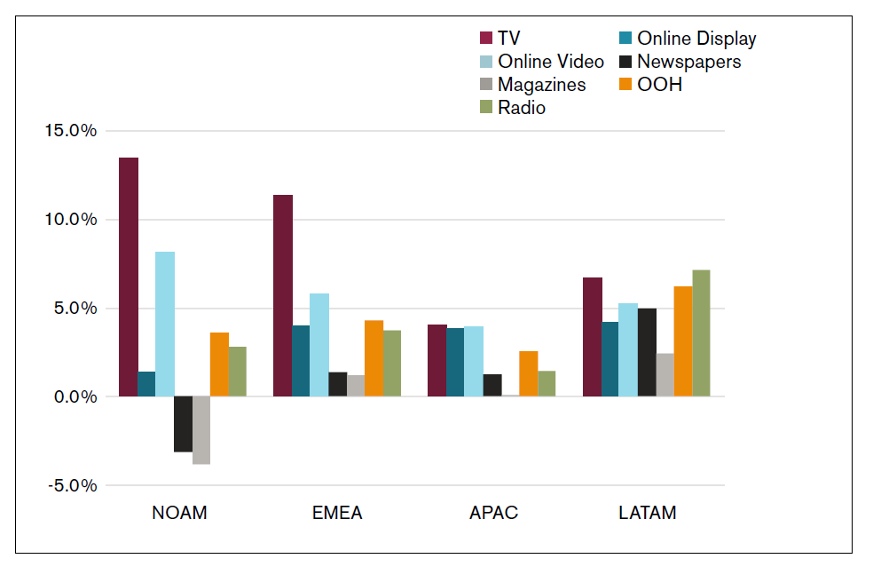

Regional media inflation 2022, by media type

By comparison, global media inflation forecasts have risen to 5.2%, a little higher than was predicted at the start of the year (4.5%). This is largely down to high CPI inflation. This trend extends to both Offline and Online inflation, which are forecast to be higher than expected at the beginning of the year. North America sees the highest overall inflation (6.2%), followed by EMEA (5.9%) and LATAM (5.8%), while inflation in APAC (3.6%) continues to be lower than in other regions, driven largely by China.

Globally, Offline is higher than Online in all regions except APAC; but all media types are expected to be inflationary, with the exception of Magazines. As anticipated, TV is experiencing steep inflation in all regions, although it is expected to be lower in APAC at 4.1%. It will be highest in North America (13.4%) and EMEA (11.3%).

ECI Media Management’s Global CEO, Fredrik Kinge, said:

“Consumer confidence grew at the start of 2022 as the world economy started to bounce back after the global pandemic, and media prices were no exception. However, while global media inflation forecasts have risen to a higher level than was predicted at the start of the year, what’s interesting is that in the UK, media inflation in 2022 is forecast to be slightly lower than was originally anticipated at the start of the year. This is driven mainly by Online inflation which is now forecast to be 2.4%, versus higher predictions at the start of the year. This drop has happened because, while online viewership has remained stable, spend has decreased. The cost-of-living crisis has undoubtedly caused advertisers decreasing their investment, which is leading to lower prices and lower inflation.

“Conversely, forecasts for TV inflation have risen since the start of the year: as eyeballs, particularly younger ones, drift to Online Video, TV advertisers are having to invest more to reach the same numbers, thereby pushing up the cost of TV advertising. With so much change in the market, it is vital that advertisers understand the transparency and effectiveness of their investments in order to drive higher media value.”

ECI Media Management’s annual Media Inflation Report, published annually in the first quarter, forecasts media inflation for seven key media channels: TV, Online Display, Online Video, Newspapers, Magazines, OOH and Radio, at a global and regional level, and across 50 countries. Today’s report is an update to the forecasts published earlier in the year, focusing on key countries. ECI Media Management’s experts have been tracking media inflation since 2012, providing unrivalled understanding of trends over time. Their information is derived from a number of sources, including their global network of experts, real client data and media agencies. It is cross-referenced with industry bodies and publications, as well as with agency traders and media vendors, so it reflects the expertise of those with an impact on trading variables.

Source: ECI Media Management

You must be logged in to post a comment Login