According to new research, private equity (PE) buyers helped to drive another buoyant six months for M&A in the marcoms sector. There were 89 PE-backed deals in H1 this year, almost double the 46 seen in the same period of 2017.

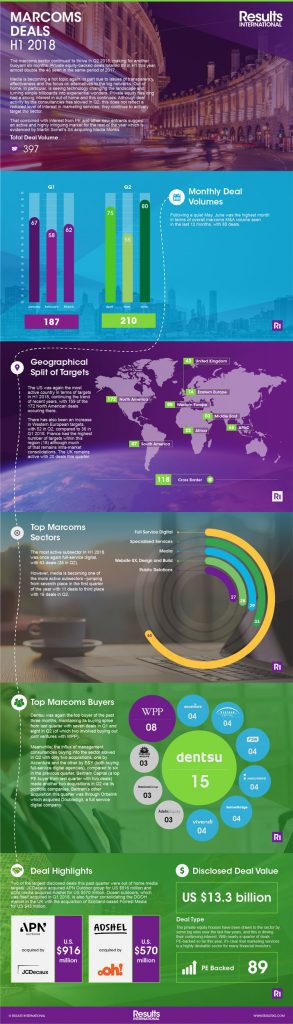

The analysis was carried out by Results International, leading global advisor on M&A and fundraising to the marketing, technology and healthcare sectors. It revealed that there were 397 deals in total in H1 and 22% involved private equity, double the 11% of total deals that were PE-backed in H1 2017.

In addition, following a quiet May, June was the highest month in terms of overall marcoms M&A volume seen in the last 12 months, with 80 deals.

Notable PE-backed deals this quarter were:

- Bertram Capital (a top buyer from Q1 with two deals) made another two acquisitions in Q2 via its portfolio companies. Bertram’s other acquisition this quarter was through Orbelink, which acquired Doubledigit a full service digital company

- Creativedrive made two acquisitions in Q1 and a further one in Q2 acquiring Zebra Worldwide, a content agency

- Clarion Events, a portfolio company of The Blackstone Group, bought B2B marketing and events company PennWell Corporation for $300m to further expand its presence in North America.

In addition, LBO France acquired a majority stake in My Media, the sixth largest media buying agency in France, for $38.9 million.

Julie Langley, partner at Results International, comments: “The private equity houses have been drawn to the sector by some big wins over the last few years, and this is driving their continuing interest. With nearly a quarter of deals PE-backed so far this year, it’s clear that marketing services is a highly desirable sector for many financial investors.”

The most active subsector in H1 2018 was once again full-service digital, with 63 deals (35 in Q2). However, media is becoming one of the more active subsectors – jumping from seventh place in the first quarter of the year with 11 deals to third place with 18 deals in Q2.

In fact, two of the largest disclosed deals this past quarter were out of home media targets: JCDecaux acquired APN Outdoor group for $916m and oOh!media acquired Adshel for $570m. Ocean Outdoors, which was itself acquired in Q1 2018, is also further consolidating the DOOH market in the UK with the acquisition of Scotland-based Forrest Media for $43 million.

The US was again the most active country in terms of targets in Q2 2018, continuing the trend of recent years, with 87 deals. There has also been an increase in Western European targets, with 52 in Q2, compared to 36 in Q1 2018. France had the highest number of targets within this region (18), although much of that remains intra-market consolidation. The UK remains active with 20 deals in Q2 2018.

Julie Langley continues: “Media is becoming a hot topic again, in part due to issues of transparency, effectiveness and the focus on alternatives to the big networks. Out of home, in particular, is seeing technology changing the landscape and turning simple billboards into experiential wonders. Private equity has long had a strong interest in out of home and this continues. Growing interest in Western European targets has also been a feature of the marcoms M&A sector in recent quarters, as buyers look to build out genuinely global offerings in response to client demand and in the search for growth.”

Dentsu was again the top buyer of the past three months, maintaining its buying spree from last quarter with seven deals in Q1 and eight in Q2 (of which two involved buying out joint ventures with WPP). Meanwhile, the influx of management consultancies buying into the sector slowed in Q2 with only two acquisitions, one by Accenture and the other by E&Y (both buying full-service digital agencies), compared to six in the previous quarter.

Julie Langley concludes: “The slowdown in deal activity by the consultancies in Q2 does not reflect a reduced level of interest in marketing services; they continue to actively target the sector. That, combined with interest from PE and other new entrants suggest an active and highly intriguing market for the rest of the year.

Source: Results International

You must be logged in to post a comment Login