WARC, the international authority on advertising and media effectiveness, has released its latest monthly Global Ad Trends report, digesting up-to-date insights and evidenced thinking from the worldwide advertising industry, with a focus on out of home advertising.

WARC, the international authority on advertising and media effectiveness, has released its latest monthly Global Ad Trends report, digesting up-to-date insights and evidenced thinking from the worldwide advertising industry, with a focus on out of home advertising.

Based on media channel data in 96 countries and detailed findings from the world’s key ad markets – Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Russia, United Kingdom and United States – which between them account for approximately two-thirds of the value of global advertising trade, key information includes:

Successful brands allocate an average 13% of their media budget to out of home

Budget allocation to out of home by successful brands within WARC’s case study database has averaged 13% over the eight years to 2016. OOH’s share has remained largely stable, which tallies with the channel’s share of global display advertising spend.

Budget allocation to out of home by successful brands within WARC’s case study database has averaged 13% over the eight years to 2016. OOH’s share has remained largely stable, which tallies with the channel’s share of global display advertising spend.

The report also finds that government and non-profit organisations (26% of budgeted spend), alcoholic drinks brands (16%) and retail brands (14%) are among the highest investors in OOH.

Out of home’s share of global advertising spend has averaged 6% since 1990

Out of home’s share of global adspend has steadily decreased since 2012, but is stable over the long-term.

Out of home’s share of global adspend has steadily decreased since 2012, but is stable over the long-term.

OOH has accounted for an average 5.9% of global advertising spend since 1990. The latest verified data show that OOH adspend amounted to $31bn in 2016, a 5.8% share of the global total. Preliminary estimates for 2017 put spend at roughly the same level.

Excluding search, classified, and other spend, OOH accounts for 7.9% of the global display ad market.

Digital accounts for over a third of all outdoor advertising expenditure and is growing rapidly

Data show that digital’s share of total global out of home advertising spend reached 34.8% in 2017. Long-term projections suggest digital’s share will rise close to 45% in 2021.

Data show that digital’s share of total global out of home advertising spend reached 34.8% in 2017. Long-term projections suggest digital’s share will rise close to 45% in 2021.

Data from WARC’s international partners show that digital’s share of total OOH adspend varies by key market and is increasing rapidly in all. In Australia, digital out of home (DOOH) adspend was at 40.2% in 2016 and likely to have raised above 45% in 2017. Preliminary estimates for 2017 put the United Kingdom’s DOOH share at 46.5% up from 37.7% in 2016; and in the US it is thought to be 22.4% in 2017 up from 20.8% in 2016.

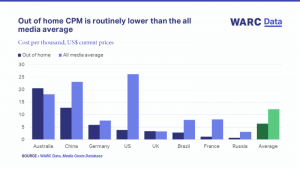

Out of home CPM is routinely lower than the all media average

Data from WARC’s Media Costs Database show that out of home cost per thousand (CPM) in key markets is routinely lower than the all media average. Australia and the UK are the only exceptions.

Data from WARC’s Media Costs Database show that out of home cost per thousand (CPM) in key markets is routinely lower than the all media average. Australia and the UK are the only exceptions.

The average CPM for an outdoor ad with an all-adult target audience in key markets is $6.41 compared to an all media average of $12.20 for the same audience.

UK consumers open to facial recognition for security purposes, but less so for marketing

Facial Recognition Technology (FRT) is being trialled as a means of offering shoppers more targeted information in stores. In a recent national survey, WARC and Toluna conclude that UK consumers are open to the application of FRT for products and services as well as for security purposes, but do not find the concept of personalised marketing messages appealing.

Facial Recognition Technology (FRT) is being trialled as a means of offering shoppers more targeted information in stores. In a recent national survey, WARC and Toluna conclude that UK consumers are open to the application of FRT for products and services as well as for security purposes, but do not find the concept of personalised marketing messages appealing.

Summing up, James McDonald, Data Editor, WARC, says: “Out of home is an industry staple, attracting a consistent share of successful brands’ budgets over the long term. The channel delivers affordable reach with CPM routinely below the all media average. Out of home is well-placed for future advancement with rising digital penetration delivering flexible creative informed by rich audience data. New tech, such as facial recognition, is being tailored to improve shopper experience, but advertisers need to heed consumer concerns.”

Global media analysis: A round-up of the importance of out of home advertising

- 3.5% average rise in out of home cost per thousand this year

- 5.9% out of home’s average share of global adspend since 1990

- 7.9% out of home’s share of global display adspend

- 13% successful brands’ budget allocation to out of home between 2009-2016

- 45% digital share of global out of home advertising spend by 2021

- 65% of UK consumers are not happy for facial recognition to be used to offer marketing messages

Other new key media intelligence on WARC Data

- Twitter finally turns a profit despite stagnation in its core US market

- Super Bowl spot spend outperforms wider US TV market

- Digital classified ads were worth more than print for the first time in 2017

- Four in five US practitioners intend to invest more in audience data this year

Global Ad Trends is part of WARC Data, a dedicated online service featuring current advertising benchmarks, data points, ad trends and user-generated expanded databases.

Source: WARC

You must be logged in to post a comment Login